General Communiqué on Collection Serial B No. 18

Introduction

In order to determine the procedures and principles regarding the implementation of certain articles of the Misdemeanor Law No. 5326 (“Law”), which is the general procedural law for administrative fines, the Ministry of Treasury and Finance (“Revenue Administration”) has published the General Communiqué on Collection Serial B, No. 18 in the Official Gazette dated May 10, 2023 and numbered 32186. The effective date of the Communiqué is set as June 1, 2023.

Within the scope of the said Communiqué, there are detailed regulations on matters such as the issues that should be included in the administrative sanction decision, notification procedure, finalization, payment period and place, enforcement procedure, statute of limitations, installments, discount and refund.

This article focuses on (i) the elements that should be included in administrative sanction decisions, (ii) finalization, (iii) the option of discounts and installments, and (iv) refunds.

Elements to be Included in Administrative Sanction Decisions

Pursuant to Article 5 of the Communiqué, administrative sanction decisions must include the following elements:

- The identity and address of the person against whom an administrative sanction decision is issued

- The act that is subject to administrative sanction and constitutes a misdemeanor, the place and time of the act, the evidence to prove that the act was committed

- Date of the decision and the identity of the public officials who issued the decision

- Amount, payment period and place of the administrative fine

- The legal remedy, authority and time period that can be applied against the administrative decision and the right to request discounted payment and installments

- Sanctions for non-payment

Finalization of Administrative Fines

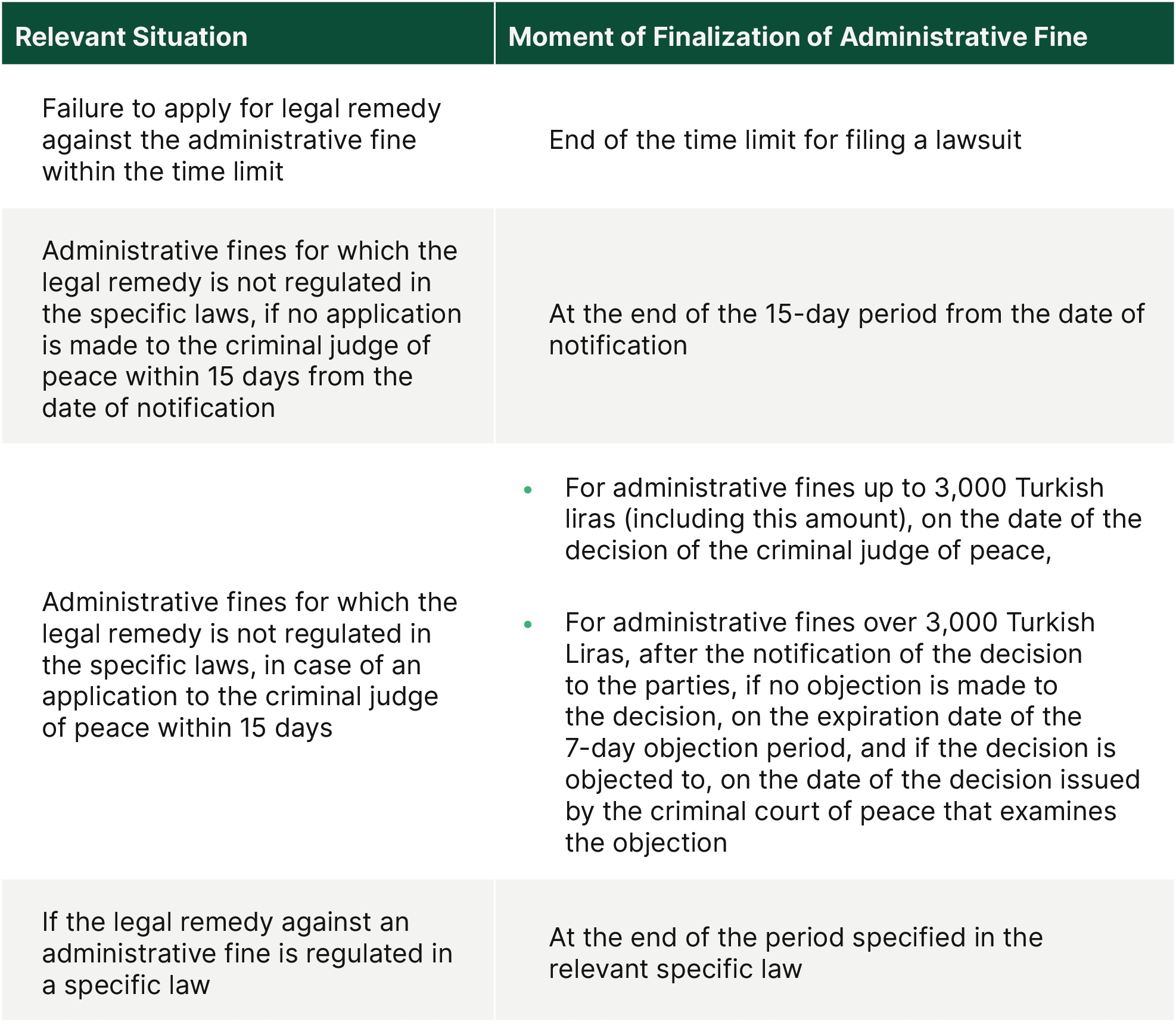

Article 7/1 of the Communiqué defines finalization of administrative fines in general terms as (i) no legal remedy is applied against the administrative sanction decision, and (ii) in cases where legal remedy is applied, the conclusion of the proceedings.

Within the framework of this general definition, it is regulated that administrative fines will be deemed finalized in the cases summarized in the table below:

Discount on Administrative Fines

Pursuant to Article 13 of the Communiqué, if the administrative fine is paid within the payment period, a 25% discount is granted. If 75% of the administrative fine is paid within the payment period, the right to discount shall be utilized.

Payment of the administrative fine does not constitute an obstacle to apply for legal remedy against the administrative sanction decision within the due time. Therefore, in the event that a lawsuit is filed simultaneously against an administrative fine paid with reservation and discount, there can be no finalization within the scope of Article 7 of the Communiqué.

The above-mentioned concepts of discounted payment and finalization are important within the scope of the “restructuring of public receivables” laws, which have come to the agenda much more in recent years.

Installments in Administrative Fines

Pursuant to Article 14 of the Communiqué, if the economic situation of the person subject to the fine is not suitable, an installment option may be requested from the unit imposing the fine within the payment period of the administrative fine. In this case, the administrative fine shall be paid in four equal installments and the first installment shall be paid within the payment period of the administrative fine and the remaining three installments shall be paid within one year from the date of notification of the administrative fine within the periods to be determined by the unit imposing the fine.

Security deposit and postponement interest shall not be required for the installments to be made within this scope. However, if the installments are not paid on time and in full, the remaining part of the fine becomes due.

Refund Procedure

Pursuant to Article 18 of the Communiqué, in the event that administrative fines that are registered as revenue to the general budget need to be refunded after they are collected by the units within the scope of the general budget, the refund procedures shall be carried out by the units making the collection.

However, in cases where administrative fines that are general budget revenues are collected by units outside the general budget and then need to be refunded, the relevant refund transaction shall be carried out:

- by the unit making the collection if it is required to be refunded before being transferred to the treasury accounts

- by the tax office to which the administrative fine was transferred if a refund is required after transfer to the treasury accounts

Conclusion

Communiqué has been issued by the Revenue Administration in order to determine the procedures and principles regarding the application of certain articles of the Misdemeanor Law No. 5326, which is the general procedural law for administrative fines, which is a public receivable in general.

It is considered that the articles of the above-mentioned Communiqué, especially the articles on finalization, discount, installment and refund, which are detailed above, should be examined on the basis of each concrete case in terms of the laws on “restructuring of public receivables”, which have been on the agenda much more in recent years.

All rights of this article are reserved. This article may not be used, reproduced, copied, published, distributed, or otherwise disseminated without quotation or Erdem & Erdem Law Firm's written consent. Any content created without citing the resource or Erdem & Erdem Law Firm’s written consent is regularly tracked, and legal action will be taken in case of violation.

Other Contents

Law No. 7456 on Additional Motor Vehicle Tax for Compensation of Economic Losses Caused by the Earthquake on 6/2/2023 and on Amendments to Certain Laws and Decree-Law No. 375 (“Law No. 7456”) was published in the Official Gazette dated 15.07.2023 and No. 32249. Law No. 7456 introduced significant...

Through Article 20 of Law No. 7440 on Restructuring of Certain Receivables and Amending Certain Laws (“Law No. 7440”), published in the Official Gazette dated 12 March 2023 and No. 32130, significant and new tax regulations regarding debt push down financing structure for merger transactions are introduced...

Provisional Article 32 was added to Banking Law numbered 5411 (“BL”) through Article 17 of the Law No. 7186 on Amendments to the Income Tax Law and Certain Laws ("Law No. 7186") in the Official Gazette on 19.07.2019. This law enables companies that are experiencing financial difficulties, but which are...

Law No. 7420 on the Amendment of Income Tax Law and Certain Laws and Decrees (“Law No. 7420“) which was published in the Official Gazette dated 09.11.2022 introduced important amendments and regulations in the tax legislation. The addition of Article 32/B, entitled "Taxation in Capital Decrease" to...

Free Zones are zones that are established to promote export-oriented investment and production, accelerate foreign direct investment and technology access, direct enterprises towards export, and develop international trade. There are many tax advantages provided to taxpayers operating in...

Through the promulgation of Law No. 7394 on the Amendments of Treasury-Owned Immovable Property Valuation and the Value Added Tax Law and on the Amendments of Certain Other Laws and Decrees, published in the Official Gazette dated 15 April 2022 and No. 31810, significant amendments...

In recent years, many new business models have emerged and traditional business models have changed greatly, within the increasing digitalization in the economy. Along with said change, challenges arose for taxing the international business income of...

Through the promulgation of the Law No. 7351, published in the Official Gazette dated 22.01.2022 and no. 31727, essential amendments are introduced to Turkish tax legislation. Apart from the tax amendments, a new provision has been added to...

Social media has emerged with the development of the digital world and internet technology and has greatly influenced the world today. One of the main categories of actors in social media is social media content producers. These people earn through social networks in...

The 1990’s hold significant importance by means of the developments that took place in the global economy. During the transition to the second half of the 1900’s, the Federal Reserve increased interest rates, and the hot money flow changed its direction from East Asian countries to the West...