Automotive Sectoral Report 2023

Authors: Alper Uzun, Rüştü Mert Kaşka, Abdullah Bozdaş, Aslı Su Çoruk

Overview

As in many sectors in Türkiye, 2023 was a challenging year for the automotive industry, but it also witnessed some interesting developments.

Due to the current economic situation, high inflation, and rising exchange rates, the continuous and rapid increase in vehicle prices since 2020 also continued in 2023. It can be said that vehicle prices increased almost 4 times from mid-2022 to the end of 2023.

The continuous increase in prices, the uncertainty in money markets, the difficulty in accessing credit, and the earthquake disaster affecting 11 provinces in the southeast of Türkiye also had a significant negative impact on the automotive sector. However, while the fact that prices were increasing day by day accelerated the demands of consumers wishing to buy an automobile or change their existing vehicle, dealerships remained empty due to supply problems. Long waiting lists had emerged as in the 1980s. The prices demanded exceeded the price lists announced by the manufacturers. Despite this, dealers were unable to find vehicles and second-hand prices surpassed zero-kilometer prices. Despite all these developments, 2023 was the year with the highest number of zero-kilometer automobiles and light commercial vehicles sold in our history.

In 2023, the sales record was broken while it was still November, with a total of 1,232,635 sales throughout the year.[1] For the first time in its history, Türkiye surpassed Spain in automobile sales and became the 5th largest market in Europe. Solving the supply problem, perceiving automobiles as an investment tool, the prospect of generating high revenues through trading, and increasing demand for electric automobiles were the major factors in the record-breaking close of 2023, which started unfavorably.

This sales record, of course, had different consequences. With the Special Consumption Tax bases remaining unchanged, there was a significant increase in the tax revenue from automobile sales. With this increase, SCT on automobiles and light commercial vehicles accounted for 10% of the total tax revenue in 2023. Almost half of SCT revenues were obtained from motor vehicles.[2]

The high demand also created an unregistered earning opportunity for those who could somehow (!) solve the supply problem. This situation in the market led to the emergence of several regulations, which we discuss in the following pages of our report.

In 2023, the country’s production and exports, like sales, increased by 19.4% to approximately USD 11 billion, while imports increased by 124.6% to approximately USD 17.5 billion.

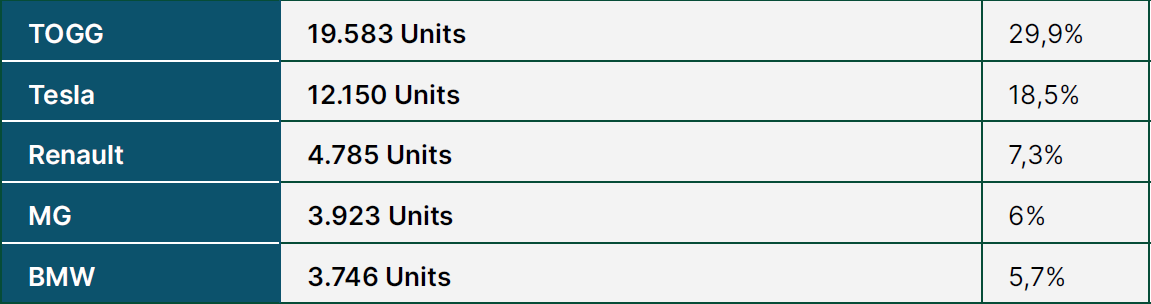

2023 was also a year in which electric vehicles, whose sales increased exponentially, came to the forefront. In addition, new brands some of which are electric and some of which produce internal combustion engines entered the market, and especially Chinese manufacturers attracted attention. The most exciting development for Türkiye was the launch of the T10X model, the first automobile of the local brand TOGG, an SUV that will compete in the compact segment. The T10X, which reached its first owners through a lottery system entered through online registration, sold a total of 19,583 units throughout 2023. Tesla, which also started sales in Türkiye in 2023, managed to sell 12,150 units in the market to which it entered with a single model (Model Y, a D-segment SUV). Chery, one of the Chinese brands that once sold in Türkiye with a different distributor but has not been in the market for many years, sold 40,590 vehicles in total with 3 different models in the market that it entered under its name in 2023 and became the 8th brand with the highest sales.

Similar to 2022, developments in the technical and regulatory infrastructure for e-mobility and electric vehicles continued.

2023 also witnessed significant developments in the second-hand automobile market. According to Turkish Statistical Institute (“TÜİK”) data, the second-hand market also increased, with a total of 10.551.762 motor vehicles sold by the end of 2023. In 2023, new legal regulations were introduced for the second-hand vehicle market, and controls on sales prices and after-sales support services were increased due to the mobility in the market and unlawful actions resulting in loss of tax.

On the other hand, considering all motor land vehicles, the number of motor land vehicles registered in Türkiye in 2023 increased by 80.3% to 2.290.280 units, while the number of vehicles deregistered decreased by 10.9% to 31.721 units. Therefore, the total number of vehicles in traffic increased by 2.258.559 units in the January-December period.[3]

As we did last year, in this report, we will explain the important legal developments in the automotive sector in 2023 and the shaping of market data.

Important Legislative Changes in 2023

Regulation Amending the Charging Service Regulation (1)

Regulation Amending the Regulation on Charging Service[4], which entered into force after being published in the Official Gazette dated 28.07.2023 and numbered 32262, emphasized that the Free Access Platform, which provides access to all charging stations across Türkiye, has been made public.

Under Article 15/2 of the Charging Service Regulation, the deadline given to legal entities holding existing charging network operator licenses to establish a charging network until 31.07.2023 has been extended until 31.01.2024.

Finally, the Regulation introduced some restrictions on legal entities whose charging network operator licenses are revoked. Accordingly, the shareholders and managers of the legal entity whose charging network operator license has been revoked are prohibited from obtaining a license for three years following the license revocation and are prohibited from being a shareholder or board member in companies applying for a license.

Regulation Amending the Charging Service Regulation (2)

With the Regulation Amending the Charging Service Regulation published in the Official Gazette dated 09.08.2023 and numbered 32274, the phrases “Business Licence” in the Charging Services Regulation were replaced with the phrase “Document”. Thus, the Regulation on Charging Services has been harmonized with the Regulation on Business Licences.

It was regulated that the “Business License” and “Site Selection and Operating Permit Documents” within the scope of the document definition must be submitted to the Energy Market Regulatory Authority by 31.07.2023.

Presidential Decree on the Special Consumption Tax Base for Electric Automobiles

With Presidential Decree No. 7803 published in the Official Gazette dated 18.11.2023 and numbered 32373, the Special Consumption Tax (“SCT”) bases of electric vehicles were amended. In this context, the base threshold for electric automobiles with an engine power below 160 kilowatts and subject to 10% SCT was increased from 1,250,000 Turkish Liras to 1,450,000 Turkish Liras. Therefore, the threshold for the application of the 40% SCT rate was raised. For vehicles with an engine power exceeding 160 kW, the threshold amount of 1.350.000 TL (60% SCT rate is applied for those exceeding this threshold) has not been changed.

Communiqué on Import of Certain Electric Vehicles (Import: 2023/22) (1)

The Communiqué on the Import of Certain Electric Vehicles (Import: 2023/22) published in the Official Gazette dated 29.11.2023 and numbered 32384 introduced some restrictions on the import of electric vehicles. According to the Ministry of Trade’s announcement on the Communiqué, the Communiqué prioritizes objectives such as reducing carbon emissions, consumer safety, monitoring the battery park, managing charging stations, and battery recycling processes.

However, this regulation was soon repealed and replaced by the Communiqué on the Import of Certain Electric Vehicles (Import: 2024/22) published in the Official Gazette dated 31.12.2023 and numbered 32416 (3rd bis).

This regulation, which stayed in force for a short period, contained regulations that, if it had remained in force, could have made it more difficult to import electric vehicles originating from China, which has recently increased.

Communiqué on Import of Certain Electric Vehicles (Import: 2024/22) (2)

With the Communiqué on the Import of Certain Electric Vehicles (Import: 2024/22) published in the Official Gazette dated 31.12.2023 and numbered 32416 (3rd bis), the previous communiqué (described above) was abolished.

According to the Communiqué, the “Permit Certificate” requirement will only apply to Class M vehicles as defined in the Highway Traffic Regulation, and Class L6 and L7 vehicles with Class M vehicle equipment.

Therefore, the principles introduced by the Communiqué, which was thought to limit the import of electric automobiles from China, have been repealed - except for the vehicles in the aforementioned class.

To issue a Permit Certificate, the following conditions must be met together:

- Establishing at least 20 authorized service stations in 7 geographical regions under Turkish Standards Institution (“TSI”) standards,

- Persons who will be responsible for electric vehicle maintenance and repair must have a qualification certificate exclusively for electric vehicle maintenance and repair by TSI or the Vocational Qualifications Authority,

- Providing service for each brand to be imported with a Turkish call center established in Türkiye with at least 40 staff,

- The manufacturer of the goods to be imported must have an authorized representative residing in the country, and

- Providing a written commitment that the importer accepts the procedures to be carried out regarding the monitoring, control and inspection of battery systems.

Regulation Amending the Regulation on Business Licenses

The Regulation on the Amendment to the Regulation on Business Licenses, which entered into force after being published in the Official Gazette dated 29.07.2023 and numbered 32263, introduced regulations on the licensing of electric vehicle charging stations.

The Regulation stipulates that a “Business License” must be obtained for stand-alone electric charging stations. For electric vehicle charging stations to be established and operated in other workplaces and collective buildings other than detached electric charging stations, it was deemed sufficient to obtain a Site Selection and Operating Permit Documents”, which was added to the Regulation as Example-10.

Regulation on the Trade of Second-Hand Motor Land Vehicles (1)

The Regulation on the Amendment to the Regulation on the Trade of Second-Hand Motor Land Vehicles published in the Official Gazette dated 06.05.2023 and numbered 32182 intervened in some market-distorting behaviors regarding second-hand vehicle sales prices .

Under the regulation, the second-hand sales authorization certificate may be temporarily revoked if the enterprise engaged in motor land vehicle trading activities engages in activities that make it difficult to access the first registered motor land vehicle, such as avoiding sales, demanding a price above the sales price recommended by the manufacturer or distributor of the vehicle, forcing the consumer to buy accessories or make a barter, or determining the trade-in price significantly below the market price.[5]

Regulation on the Trade of Second-Hand Motor Land Vehicles (2)

With the Regulation Amending the Regulation on the Trade of Second-Hand Motor Land Vehicles published in the Official Gazette dated 06.07.2023 and numbered 32240, the marketing of second-hand vehicles through advertisements at a price above the current sales price recommended by the manufacturer or distributor is prohibited until 01.01.2024.

In addition, real or legal persons who act as intermediaries for the publication of advertisements for vehicle sales became obliged to warn those who place advertisements in violation of the regulation before the advertisement is published and to inform the Ministry of Trade about the advertisements in violation of the regulation and the advertisers.

Motor Vehicle Tax General Communiqué Serial No. 56

With the Motor Vehicles Tax General Communiqué Serial No. 56 published in the Official Gazette dated 30.12.2023 and numbered 32415 (2nd bis), the motor vehicles tax amounts to be applied as of 01.01.2024 were determined and announced.

You can access the communiqué and the motor vehicle tax tariffs for 2024 in Turkish here.

Details on the Notable Changes

As can be seen from the changes summarized above, in 2023, the Turkish automotive sector witnessed significant legal developments regarding electric vehicles and related infrastructure. In particular, the regulations regarding the import of electric vehicles, charging services, and after-sales support services were among the most remarkable developments in the sector.

The Communiqué on the Import of Electric Vehicles regulated the entry of electric vehicles into the Turkish market by introducing various requirements for electric vehicles to be imported. In addition, amendments to the Regulation on Charging Services introduced new rules on the provision of charging services and charging network operations. These legislative amendments reflected the objectives of expanding the use of electric vehicles, ensuring consumer safety, and supporting the sustainable development of the automotive sector.

In the past year, regulations were introduced against the rapid price increases in the second-hand market and behaviors that negatively affected the market. In 2023, important regulations on the trade of second-hand motor vehicles entered into force. Both the impact of these regulations and the fact that the automobile is also perceived as an investment tool in Türkiye in response to the aggravating economic conditions have positively reflected on the second-hand automotive market.

Communiqué on Import of Electric Vehicles

The “Communiqué on the Import of Electric Vehicles” (Import: 2024/22) published in the Official Gazette No. 32416 (3rd bis) on December 31, 2023 introduced new regulations on the import of electric vehicles in Türkiye. The Communiqué abolished the Communiqué numbered “Import 2023/22”, which had been in force for a very short period, while the import restrictions introduced by the abrogated Communiqué were maintained for certain classes of vehicles.

With the new regulation, the obligation to obtain a permit, which had a wider scope in the previous Communiqué, is now only valid for Class M vehicles and Class L6 and L7 vehicles with Class M vehicle equipment.

The Communiqué regulated the conditions to be met for the issuance of the authorization certificate. These conditions include the establishment of adequate authorized service stations for after-sales services, the relevant personnel having the necessary qualification certificates, Turkish call center service, and the importer’s commitment to monitor battery systems.

Regulations on the Second-Hand Market

In 2023, important legislative changes and regulations were introduced for the second-hand automobile market in Türkiye. These amendments focused on protecting consumer rights and preventing speculative movements in the market.

There are a few key developments that stand out in the legislation. First, stricter regulations have been introduced to verify the accuracy of vehicle mileage data. It is aimed at preventing malicious behavior such as mileage reduction. In addition, it has become mandatory to transparently share information such as past damage records and inspection reports with buyers. These regulations aim to increase transparency and reliability in the second-hand market, enabling buyers to make more informed decisions.

Regulations on Charging Services and Stations

In 2023, as electric vehicles became widespread in Türkiye, important regulations were introduced regarding charging services and stations. These regulations were developed to encourage the use of electric vehicles and strengthen the infrastructure in this area.

Among the main developments in the legislation is the widespread use and increased accessibility of charging stations. With the new regulations, it has become mandatory to establish charging stations at certain intervals on urban and intercity roads. In addition, standards for charging stations have been set to provide compatible charging options for all electric vehicles. These standards aim to reduce charging times and make the charging process more efficient.

As is well known, increasing the number and improving the accessibility of charging stations is both a prerequisite and a source of motivation for electric vehicle users. Expanding and standardizing charging stations also increases the sales and use of electric vehicles, encouraging a sustainable and environmentally friendly transformation in Türkiye’s automotive sector. In addition, these steps contribute to achieving the country’s energy efficiency and environmental sustainability goals.

Recent Competition Board Decisions

In the context of sectoral developments in the automotive market, the decisions of the Competition Board played an important role. This table summarizes the highlights of these decisions, provides information on their potential impact on the automotive sector, and offers explanations on competition and regulations in the sector. These decisions will play an important role in shaping the future of the sector.

Merger and Acquisition Decisions

Maysan Mando / Halla Holdings Decision[6]

The decision is related to the evaluation of the acquisition of the sole control of Maysan Mando Otomotiv Parçaları Sanayi Ticaret A.Ş. (“Maysan”) by Halla Holdings Group (“Halla”) through Mando Corporation (“Mando”).

Mando’s main field of activity is the production of automotive parts. In Türkiye, it operates in the fields of anti-lock braking systems, electronic stability control, and electrically assisted steering box. Maysan, the target undertaking, operates in the shock absorber distribution and sales market in Türkiye. Maysan manufactures and sells shock absorbers for passenger cars, light commercial vehicles, buses, and heavy trucks, as well as railways and military applications. The Board stated that Mando has limited sales in Türkiye and emphasized that these sales are different from the products manufactured and distributed by Maysan. Accordingly, the Board assessed that there is no horizontal or vertical overlap between the fields of activity of the transaction parties within Türkiye.

As a result, the Board authorized the transaction since there was no significant impediment to effective competition as a result of the transaction.

Good Life / Toyota Tsusho Decision[7]

The decision concerns the evaluation of the acquisition by Toyota Tsusho Corporation (“TTC”) of the shares giving Mitsubishi Corporation (“MC”) a controlling interest in Good Life Design Co. Ltd (“GLD”), which is jointly controlled by Toyota Motor Corporation (“TMC”) and Mitsubishi Corporation.

The Board stated that there is no horizontal or vertical overlap between the activities of TMC and TTC in Türkiye and the activities of GLD since GLD operates only in Japan and does not have any activities in Türkiye. However, the Board found that there is a vertical relationship between TTC’s activities related to the sale of automotive materials in Türkiye (upstream market) and TMC’s activities related to the production of automotive vehicles (downstream market). On the other hand, the Board concluded that the vertical overlap between TTC and TMC would not lead to a coordination effect, considering that the parties’ shares in these markets remained limited.

As a result, the Board authorized the transaction since there was no significant impediment to effective competition as a result of the transaction.

Stellantis/Tofaş Final Examination Decision[8]

The Board took the application regarding the acquisition of the sole control of Stellantis Otomotiv Pazarlama A.Ş. by Tofaş Türk Otomobil Fabrikası A.Ş. under final review (Phase II review) with its decision dated 23.11.2023 and numbered 23-54/1029-M.

Under Article 7 of Law No. 4054, the Board is authorized to supervise mergers and/or acquisitions that may result in a significant impediment to effective competition in the markets. The Board may take a final review of the transactions, which need to be deepened in terms of their effects on the structure of competition in the market, within the framework of Article 10 of Law No. 4054.

According to Article 10 of Law No. 4054, a merger/acquisition transaction notified to the Board is pending until the final decision and cannot be put into practice. However, the fact that the transaction is under final review does not mean that the transaction cannot be authorized. Therefore, the Board is expected to complete its ongoing evaluation of the transaction in 2024.

Investigations

Vehicle Rental Preliminary Investigation Decision[9]

A preliminary investigation was initiated against 12 undertakings regarding the allegation that various undertakings engaged in automobile rental activities violated Article 4 of Law No. 4054 on the Protection of Competition.

From the evidence obtained, it has been observed that some undertakings engaged in automobile rental activities may have competitors’ vehicle stock numbers, competitor price offers to customers, new vehicle purchase data, and competitor market shares. Therefore, it has been deemed necessary to determine whether such information was obtained through direct communication between competitors, considering that such information may constitute competition-sensitive strategic information.

The Board stated that, among the hundreds of documents received during the on-site inspections, no document could be identified to show that price offers of competitor undertakings were shared directly between competitors to restrict competition. From the on-site inspection documents, it is understood that competitors’ price offers were shown to automobile rental companies during customer visits, that price information could be obtained as a result of field studies, or that the customer could directly send the price offer received from an undertaking engaged in automobile rental activities to the competitor in written form or as a screenshot, or send an e-mail correspondence containing the offer.

The Board stated that due to the way the automobile rental sector operates, undertakings operating in the sector can closely monitor the prices of competitors through market research and that they can obtain information about the price offers of other market players without the need for additional effort - through their customers. In addition, the Board further stated that a bargaining scheme in which customers share the price offer received from one undertaking with another undertaking to obtain a better price offer and increase their bargaining power is very common.

As a result, the Board concluded that the correspondence did not give rise to competitive concerns and decided not to initiate a full-fledged investigation.

Market Data

There are over thirty distributors of automobiles and light commercial vehicles active in Türkiye. Information on the brands sold in the Turkish market and their distributors are as follows:

- Alfa Romeo, Fiat, Lancia, Jeep: Tofaş Türk Otomobil Fabrikası A.Ş.

- Aston Martin, Hongqi: D ve D Motorlu Araçlar A.Ş.

- Audi, Cupra, Seat, Volkswagen, Bentley, Lamborghini, Porsche: Doğuş Otomotiv Servis ve Ticaret A.Ş.

- BMW, MINI, Land Rover, Jaguar: Borusan Otomotiv İthalat ve Dağıtım A.Ş.

- BYD: ALJ Pazarlama ve Satış A.Ş.

- Chery: Chery Otomobil Sanayi ve Ticaret A.Ş.

- Citroen, DS, Opel, Peugeot: Stellantis Otomotiv Pazarlama A.Ş.

- Ferrari, Maserati: Fer Mas Oto Ticaret A.Ş.

- Ford: Ford Otomotiv Sanayi A.Ş.

- Honda: Honda Türkiye A.Ş.

- Hyundai: Hyundai Assan Otomotiv Sanayi ve Ticaret A.Ş.

- Isuzu: Anadolu Isuzu Otomotiv Sanayi ve Ticaret A.Ş.

- Iveco: Iveco Araç Sanayi ve Ticaret A.Ş.

- KIA: Çelik Motor Ticaret A.Ş.

- Lada: Sever Oto Otomotiv San. Ve Tic. Ltd. Şti.

- Leapmotor, Skywell: Ulu Motor Sanayi Ve Ticaret A.Ş.

- Karsan: Karsan Otomotiv Sanayii ve Tic. A.Ş.

- Mazda: Mazda Motor Logistics Europe NV

- Mercedes-Benz, Smart: Mercedes Benz Otomotiv Ticaret ve Hizmetleri A.Ş.

- MG: Doğan Trend Otomotiv Tic. Hiz. ve Teknoloji A.Ş.

- Mitsubishi: Temsa Motorlu Araçlar Pazarlama ve Dağıtım A.Ş.

- Nissan: Nissan Otomotiv A.Ş.

- Renault, Dacia: MAIS Motorlu Araçlar İmal ve Satış A.Ş.

- Rolls Royce, Lotus: Royal Motors Sanayi ve Ticaret Ltd. Şti.

- Skoda: Yüce Auto Motorlu Araçlar Tic. A.Ş.

- SsangYong, Seres, DFSK: Şahsuvaroğlu Dış Ticaret Ltd. Şti

- Subaru: Baytur Motorlu Vasıtalar Tic. A.Ş.

- Suzuki: Suzuki Motorlu Araçlar Pazarlama A.Ş.

- Tesla: Tesla Motorları Satış ve Hizmetleri Ltd. Şti.

- Togg: Türkiye'nin Otomobili Girişim Grubu Sanayi ve Ticaret A.Ş.

- Toyota, Lexus: Toyota Türkiye Pazarlama ve Satış A.Ş.

- Volvo: Volvo Car Turkey Otomobil Ltd. Şti.

Assessment of the Automobile and Light Commercial Vehicle Market

The Turkish automotive market was quite active in 2023 in every sense. Despite the supply problem in the first half of the year, the earthquake disaster, and the elections, as we had predicted in our 2022 report[10], with the solution of the supply problem in the second half of the year, the regulations on the purchase and sale of second-hand vehicles, the distributors’ discounts from list prices and low-interest loan campaigns, the 1.000.000 threshold was exceeded for the first time in our history in November and the all-time sales record was broken by the end of the year.

According to data from the Automotive Distributors & Mobility Association, the total number of sales in the automobile and light commercial vehicle market as of January-December 2023 was 1.232.635. This means a significant increase of 57.4% compared to the previous year.[11]

A total of 967.341 automobiles and 265.294 light commercial vehicles were sold in 2023. In the face of these sales figures, the sales realized in December 2023 also attracted attention. The sales figure for December was recorded[12] as 126.416 for automobiles and 32.237 for light commercial vehicles. Based on the last year’s data, the total retail amount was realized as 783.283.

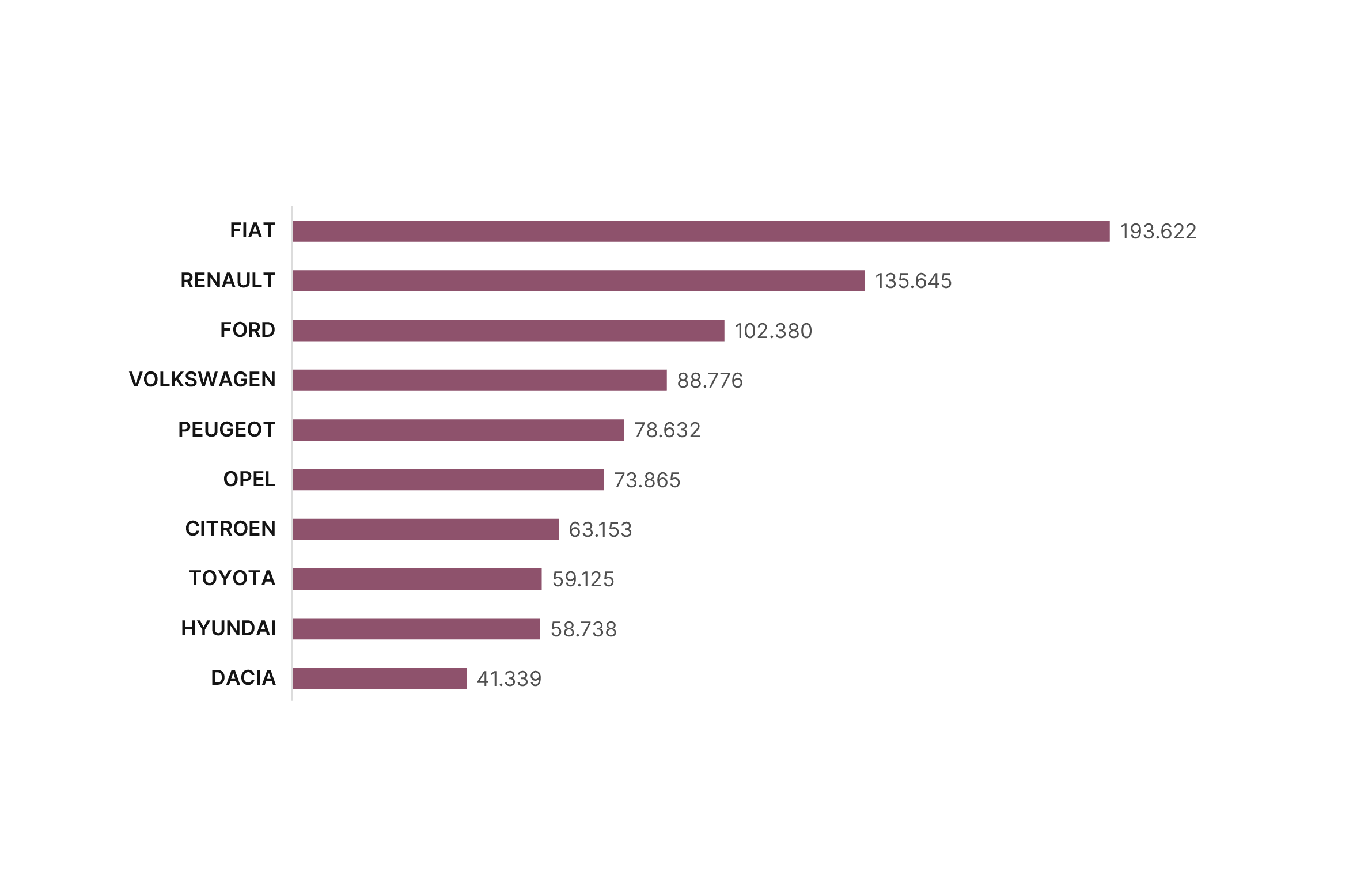

In 2023, the 10 brands with the highest sales were as follows:

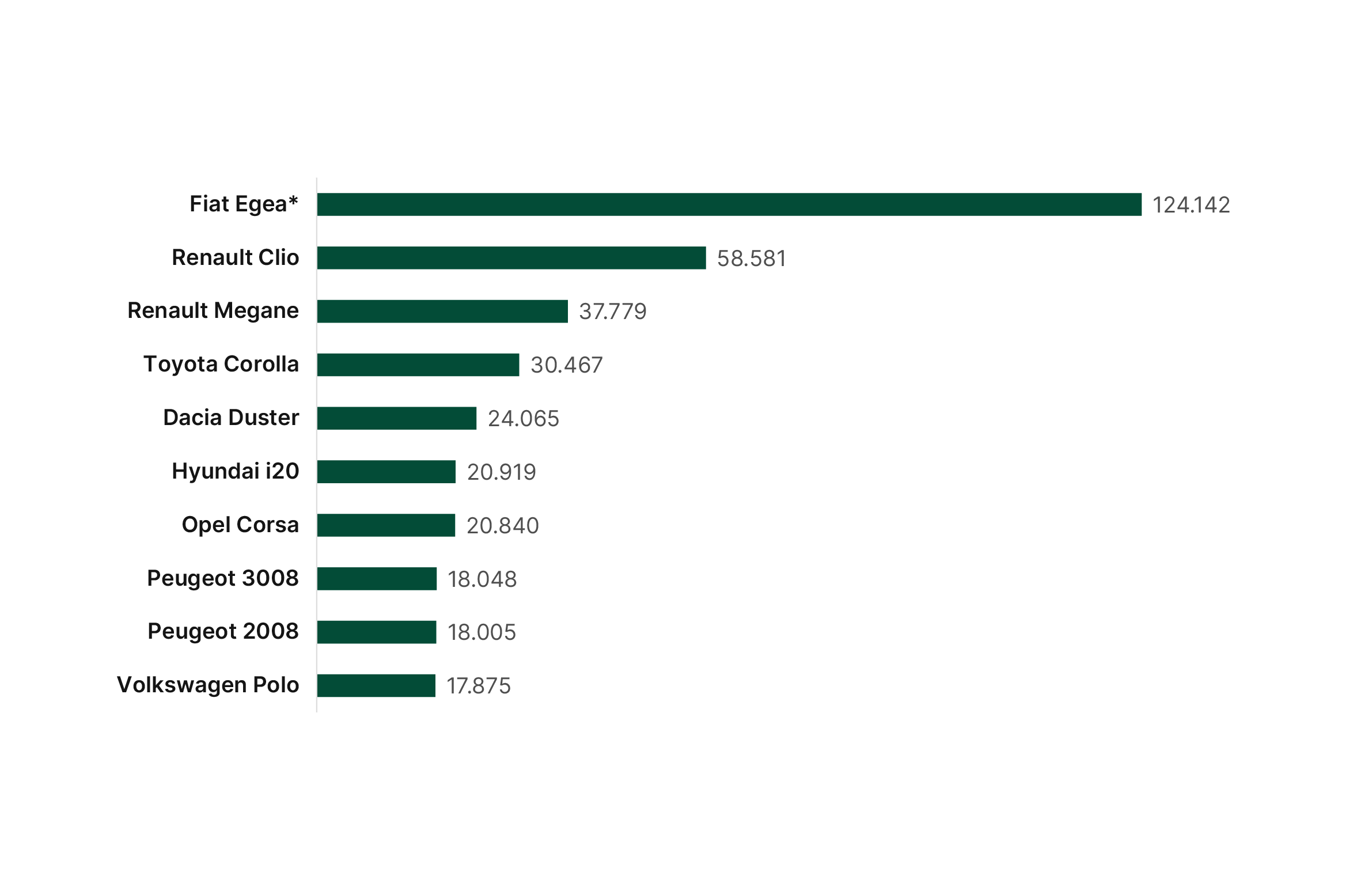

While 323 different models of 48 brands were sold in Türkiye in 2023, Fiat Egea was the most preferred vehicle. Sold with Sedan, Hatchback, Cross, Station Wagon, and Cross Wagon body options in Türkiye and Fiat Tipo in the European market, Egea has managed to maintain its top position for 8 consecutive years by selling a total of 124.142 units with all body options. Only the sedan body type of the Fiat Egea sold 80.768 units, making it the most preferred automobile even with this body type. The 10 models with the highest sales in Türkiye were as follows:

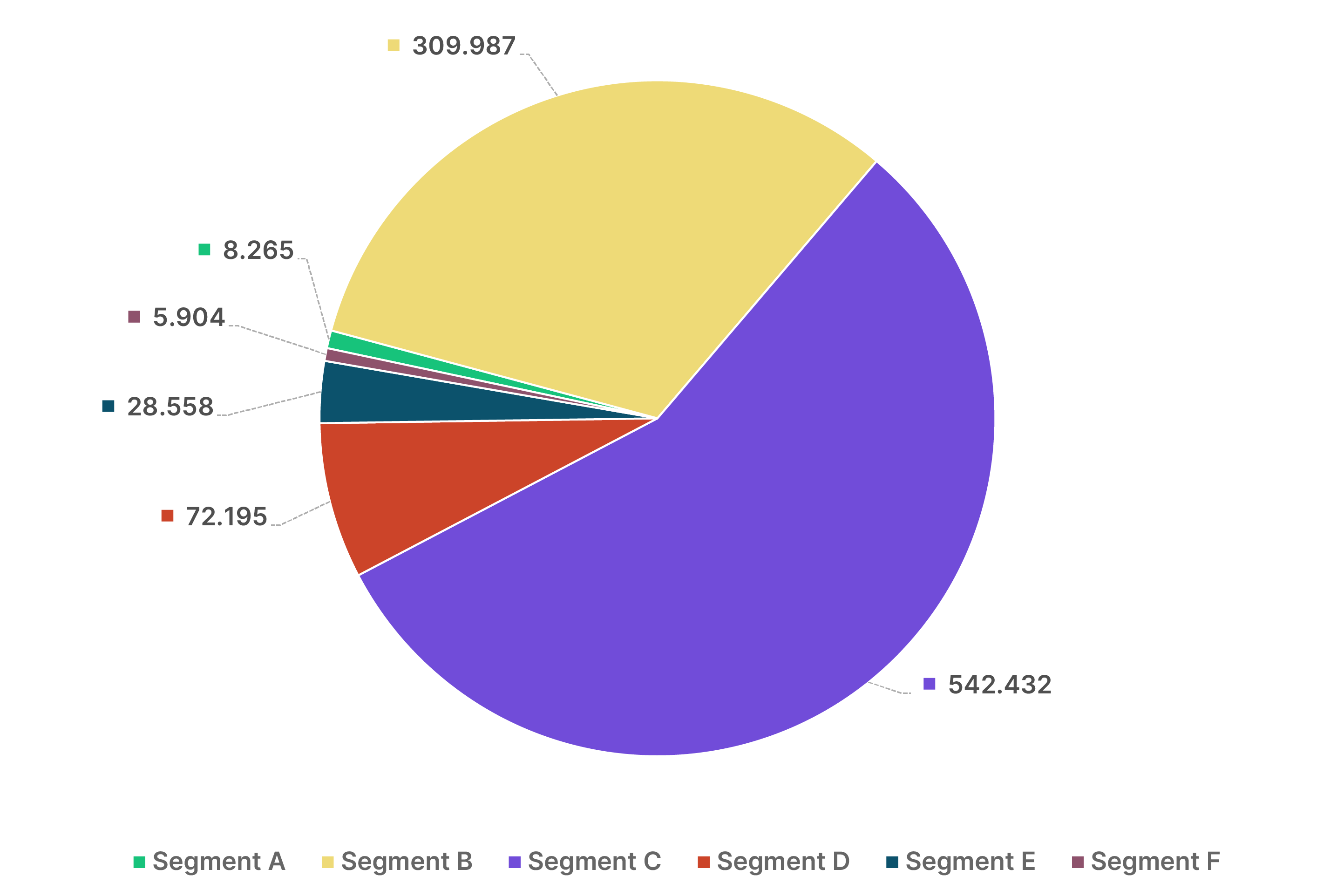

According to 2023 sales data[13], 86% of the automobiles sold are B and C-segment vehicles, in other words, small and lower middle-class vehicles. The main reason for this is that the prices of automobiles have risen significantly in 2023 and the high tax burden on vehicles with large engines:

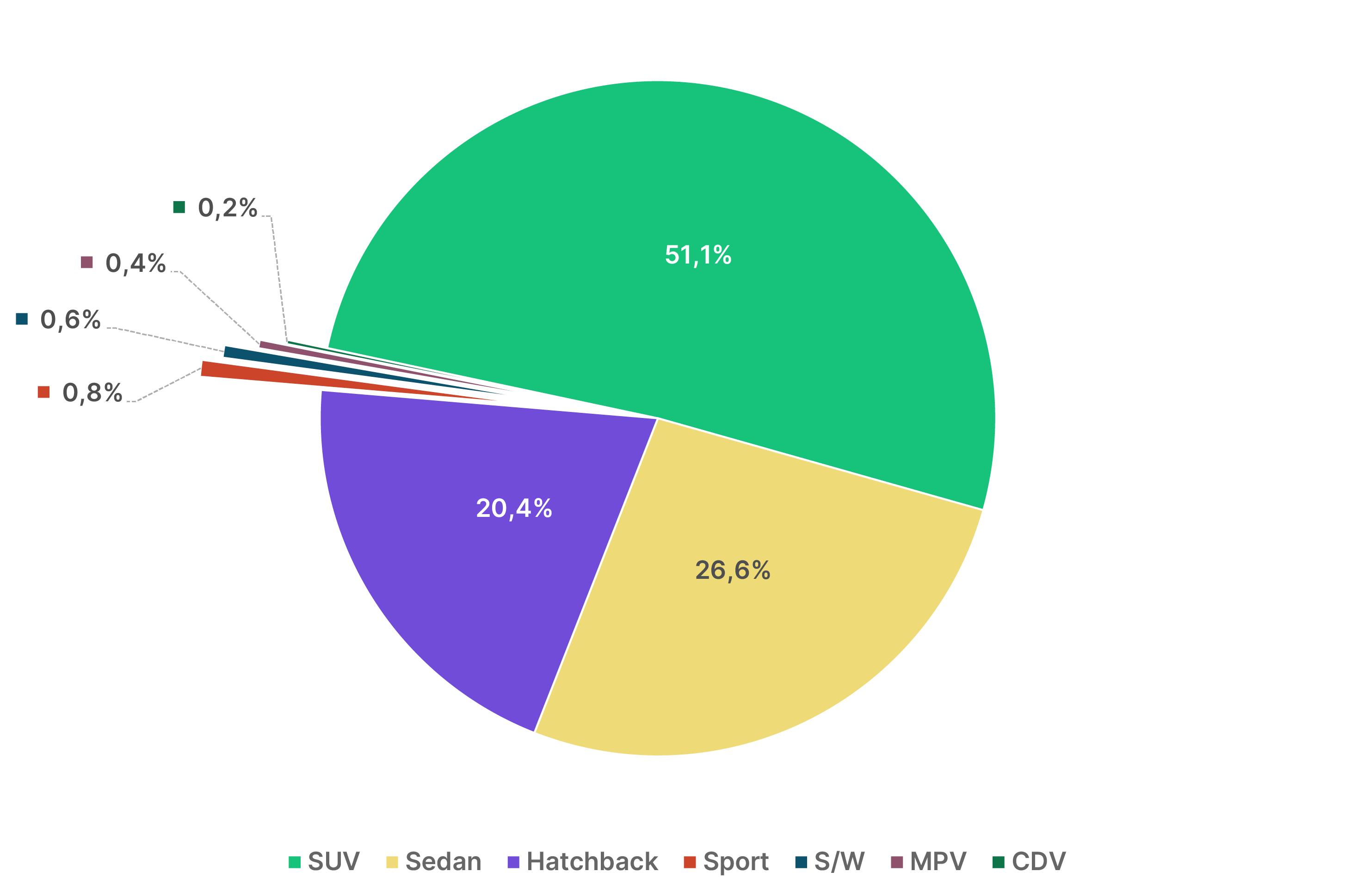

In 2023, just like in 2022, the most preferred body type was SUV. While almost 1 out of every 2 automobiles sold was SUV, 10 years ago, in 2013, this ratio was 11.56%. While Sedan and Hatchback body types dominated the market at that time, now the total of other body types do not sell as much as SUV body types. The breakdown by body type was as follows:

Out of the 967.341 automobiles sold, 311.352 (32.19%) were domestically produced, while 655.989 (67.81%) were imported.

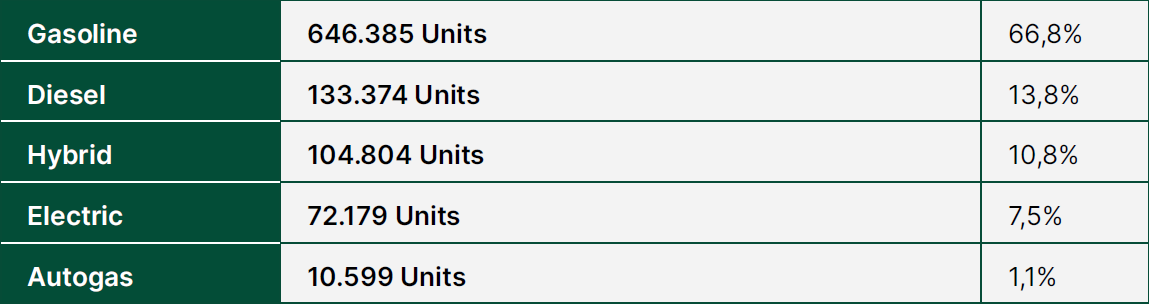

Sales and market shares by engine type were as follows. As can be seen, sales of electric automobiles were almost 10 times higher than last year, while sales of diesel-powered vehicles continued to decline:

In 2023, the popularity and prevalence of electric automobiles increased dramatically. While one of the first reasons that comes to mind is the entry of the local brands TOGG and Tesla, the most well-known electric automobile manufacturer at the global level, in our opinion, the biggest reason is the lower tax burden on electric automobiles. As it is known, the SCT rate is 10% for electric vehicles with an engine power of 160 kW (approximately 217 HP according to the Horsepower measurement unit commonly used in internal combustion engine vehicles) and below and whose tax base does not exceed 1.450.000 TL. This, of course, made it possible to acquire technological, fuel-efficient, up-to-date, and powerful vehicles at much more affordable prices than similarly powerful internal combustion engine automobiles in the Turkish automobile market, where there are almost no internal combustion engine automobiles with SCT rates below 80%. Following this SCT regulation, many brands launched suitable vehicles. In addition, with the development of the infrastructure for charging and other needs suitable for electric automobiles, while only 7733 electric automobiles were sold in Türkiye in 2022, this number increased exponentially in 2023 and a total of 72.179 units were sold.

Due to the Special Consumption Tax (“SCT”) system on automobiles in Türkiye and the fact that SCT bases were not increased despite the inflationary environment and rising exchange rates, sales of vehicles with large internal combustion engines decreased further and sales of automobiles with internal combustion engines below 1600 cc increased by 51.7% and reached 80.8% share. Among 945.768 automobiles registered in the January-December period, 33.2% of them had 1300 cc or less, 23.4% had 1401-1500 cc, 19.6% had 1301-1400 cc, 10.5% had 1501-1600 cc, 5.7% had 1601-2000 cc, 0.7% had 2001 cc and above engines. The market share of automobiles with automatic transmission continued to grow and reached 83.1%.

The top 5 brands offering electric vehicles and their market shares are as follows:

Here are the top 3 best-selling models in each segment, with all body types:

In 2023, automobile production increased by 17.5%. Oyak-Renault with 325.366 units, Hyundai with 242.016 units, Toyota with 212.843 units, Tofaş with 171.072 units, and Ford Otosan with 1.370 units were the top 5 automobile producers. Likewise, automobile exports increased by 16% in 2023. Oyak-Renault exported 230.397 units, Hyundai 205.200 units, Toyota 184.797 units, and Tofaş 42.696 units.

Commercial vehicle production also increased by around 5% in 2023, although not as much as the increase in automobile production. Ford Otosan with 397.424 units, Tofaş with 68.356 units, Mercedes Türkiye with 31.988 units, Anadolu Isuzu with 5.976 units, Otokar with 5.018 units were the top 5 producers of commercial vehicles.

Finally, as the consumers tend to prefer vehicles in the low SCT tranche in the Turkish automotive market, which had 28.740.492 registered motor vehicles as of end-2023, with an average age of 14.5 years as calculated by the Turkish Statistical Institute, it is expected that such attraction of affordable electric or small engine volume options will increase.

Although Türkiye’s current economic situation and inflationary environment are expected to continue in 2024, we believe that demand in the automotive market will remain close to 2023. It should also be noted that TOGG’s new “fastback” body type model T10F, which was introduced in 2023, has created excitement.

It can be anticipated that, first of all, existing brands will increase their electric automobile options suitable for the 10% SCT bracket, new brands offering an affordable model range and especially Chinese manufacturers will enter the market, and electric automobile sales will continue to increase exponentially. Although we have not heard of any concrete efforts to change SCT rates or increase SCT bases, we believe that no reduction should be expected in this context, considering the tax revenue generated from automobiles.

You can download PDF version of the bulletin here.

- Automotive Distributors’ and Mobility Association, 2023 Passenger Car and Light Commercial Vehicle Market Evaluation, https://www.odmd.org.tr/web_2837_1/neuralnetwork.aspx?type=35 (Date of access: 08.01.2024)

- Republic of Türkiye Ministry of Treasury and Finance, December 2023 Budget Realization Results, https://www.hmb.gov.tr/2023-aralik-ayi-butce-gerceklesme-sonuclari (Date of Access: 01.02.2024)

- TÜİK, Motor Land Vehicles 2023, https://data.tuik.gov.tr/Bulten/Index?p=Motorlu-Kara-Tasitlari-Aralik-2023-49432, (Date of access: 01.02.2024)

- For detailed explanations on the Charging Service Regulation, see: Kaşka, Rüştü Mert: “Electric Vehicle Charging Network Operating License” (https://www.erdem-erdem.av.tr/en/insights/electric-vehicle-charging-network-operating-license, Date of access: 04.01.2024)

- For more detailed explanations, see: Uzun, Alper: “Regulation on the Trade of Second-Hand Motor Vehicles and Recent Regulations” (https://www.erdem-erdem.av.tr/en/insights/regulation-on-the-trade-of-second-hand-motor-vehicles-and-recent-regulations, Date of Access: 03.01.2024)

- Competition Board’s decision dated 02.06.2022 and numbered 22-25/404-168.

- Competition Board’s decision dated 15.12.2022 and numbered 22-55/855-354.

- The announcement regarding the final examination of the takeover application can be accessed via the following link: https://www.rekabet.gov.tr/en/Guncel/the-acquisition-of-the-sole-control-of-s-540376639d95ee118eca00505685da39 (Date of access: 11.12.2023)

- Competition Board’s decision dated 21.07.2022 and numbered 22-33/526-212.

- Erdem & Erdem: Automotive Sectoral Report 2022, https://www.erdem-erdem.av.tr/en/insights/automotive-sectoral-report-2022

- Automotive Distributors’ and Mobility Association, 2023 December, Passenger Car and Light Commercial Vehicle Market Evaluation, https://www.odmd.org.tr/web_2837_1/neuralnetwork.aspx?type=35 (Date of access: 08.01.2024)

- Automotive Distributors’ and Mobility Association, 2023 December, Passenger Car and Light Commercial Vehicle Market Evaluation, https://www.odmd.org.tr/web_2837_1/neuralnetwork.aspx?type=35 (Date of access: 08.01.2024)

- Automotive Distributors & Mobility Association: Macroeconomic Assessment - December 2023 (https://www.odmd.org.tr/folders/2837/categorial1docs/4585/Makroekonomik%20Değerlendirme%20-%20Aralık%202023.pdf , Date of access: 08.01.2024)

All rights of this article are reserved. This article may not be used, reproduced, copied, published, distributed, or otherwise disseminated without quotation or Erdem & Erdem Law Firm's written consent. Any content created without citing the resource or Erdem & Erdem Law Firm’s written consent is regularly tracked, and legal action will be taken in case of violation.